UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under Section 240.14a-12 |

SENSIENT TECHNOLOGIES CORP |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | | | No fee required |

| | | ||

☐ | | | Fee paid previously with preliminary materials |

| | | ||

☐ | | | Fee computed on table |

March 6, 2020

15, 2023

Dear Fellow Shareholder:

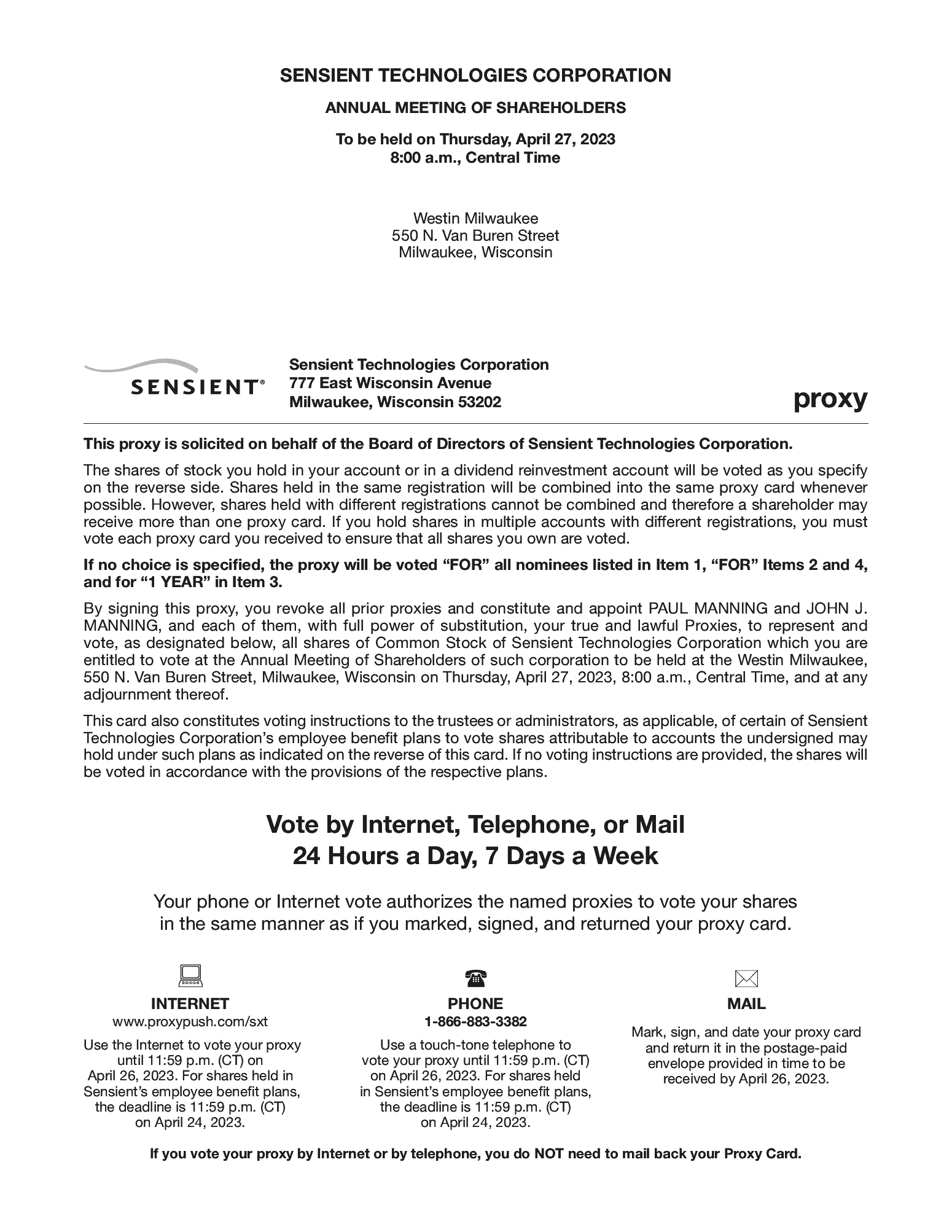

You are invited to attend the Annual Meeting of Shareholders of Sensient Technologies Corporation. The meeting will be held on Thursday, April 23, 2020,27, 2023, at 8:00 a.m., Central Time, at the Westin Milwaukee, 550 North Van Buren Street, Milwaukee, Wisconsin.

I hope that you will be able to join us atfor the meeting: (i) to elect ten directors nominated by the Board of Directors of the Company as described in the Proxy Statement; (ii) to give an advisory vote on our executive compensation; (iii) to give an advisory vote as to the frequency of the shareholder votes on our executive compensation; and (iii)(iv) to ratify the appointment of Ernst & Young LLP, certified public accountants, as the independent auditors of the Company for 2020;2023; and to transact such other business as may properly come before the meeting or any adjournment thereof.

Whether or not you plan to attend the meeting, it is important that you exercise your right to vote as a shareholder. Please indicate your vote by completing your proxy in one of three ways according to the instructions contained in the Notice of Internet Availability of Proxy Materials: (1) vote by telephone; (2) vote by Internet; or (3) complete a proxy card and return it using the envelope provided. Be assured that your votes are completely confidential.

We are also delivering our 20192022 Annual Report on Form 10-K by mail or over the Internet for your review.

On behalf of the officers and directors of the Company, thank you for your continued support and confidence.

Sincerely,

Paul Manning

Chairman, President and Chief Executive Officer

SENSIENT TECHNOLOGIES CORPORATION

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Notice of Annual Meeting to be held on April 27, 2023

To the Shareholders of Sensient Technologies Corporation:

NOTICE IS HEREBY GIVEN that the 2023 Annual Meeting of Shareholders (“Meeting”) of Sensient Technologies Corporation, a Wisconsin corporation (“Company”), will be held at the Westin Milwaukee, 550 North Van Buren Street, Milwaukee, Wisconsin, on Thursday, April 27, 2023, at 8:00 a.m., Central Time, for the following purposes:

| 1. | To elect ten directors nominated by the Board of Directors of the Company as described in the proxy statement; |

| 2. | To give an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion in the proxy statement; |

| 3. | To give an advisory vote as to whether the shareholder votes regarding our executive compensation should occur every year, every two years, or every three years; |

| 4. | To ratify the appointment of Ernst & Young LLP, certified public accountants, as the independent auditors of the Company for 2023; and |

To transact such other business as may properly come before the Meeting or any adjournments thereof.

Important Notice Regarding the Internet Availability of Proxy Materials

for the Shareholder Meeting to be held on April 27, 2023

The Proxy Statement and Notice of Annual Meeting and the 2022 Annual Report on Form 10-K

are available on Sensient’s website at http://investor.sensient.com.

The Board of Directors has fixed the close of business on March 1, 2023 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Meeting and any adjournments thereof. Holders of a majority of the outstanding shares must be present at the Meeting or by proxy in order for the Meeting to be held. As allowed under the Securities and Exchange Commission’s rules, we have elected to furnish our proxy materials over the Internet to most shareholders and deliver printed proxy materials to Sensient’s employee benefit plan participants that have not received notice of default electronic delivery and other shareholders who have requested paper copies. We have mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to those shareholders who will receive our proxy materials over the Internet. The Notice contains instructions on how to access the proxy statement and our Annual Report on Form 10-K via the Internet and how to vote.

Shareholders of record who wish to vote in person may do so at the Meeting. Whether or not you are able to attend the Meeting, to ensure that your shares are represented at the Meeting, please complete your proxy in one of three ways: (1) vote by telephone; (2) vote by Internet; or (3) complete a proxy card and return it using the envelope provided, each according to the instructions provided in the proxy statement or contained in the Notice. You may revoke your proxy at any time before it is actually voted by delivering a notice in writing to the undersigned (including by delivering a later-executed proxy or voting by telephone or by Internet) or by voting in person.

| | | On Behalf of the Board of Directors | |

| | | ||

| | | John J. Manning, Secretary Milwaukee, Wisconsin March 15, 2023 |

PROXY VOTING INSTRUCTIONS

If you are a record holder, you may cast your vote in person at the 2023 Annual Meeting of Shareholders (the “Meeting”) or by any one of the following ways:

BY TELEPHONE: You may call the toll-free number indicated in the Notice of Internet Availability of Proxy Materials (the “Notice”) or on your proxy card. Follow the simple instructions and use the personalized control number specified in the Notice or on your proxy card to vote your shares. You will be able to confirm that your vote has been properly recorded. Your telephone vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed, and returned a proxy card.

OVER THE INTERNET: You may visit the website indicated in the Notice or on your proxy card. Follow the simple instructions and use the personalized control number specified in the Notice or on your proxy card to vote your shares. You will be able to confirm that your vote has been properly recorded. Your Internet vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed, and returned a proxy card.

BY MAIL: You may mark, sign, and date a proxy card received by mail and return it in the postage-paid envelope provided.

If you are a participant in a Sensient employee benefit plan, you have the right to instruct the trustees and/or administrators of such plans to vote the shares allocated to your plan account. If no instructions are given, or if your voting instructions are not received by the deadline shown on the voting instruction form, the uninstructed shares will be voted in accordance with the provisions of the applicable plan.

If you are a beneficial holder, you may receive additional instructions from the bank or broker that holds shares for your benefit on how to vote your shares with these proxy materials or with the Notice. If a broker does not receive voting instructions from the beneficial owner on the election of directors, on the approval of our executive compensation, or on the frequency of shareholder advisory votes concerning our executive compensation, the broker may not vote such shares and may return a proxy card with no vote on these matters, in which case such shares will have no effect in the outcome of such matters (except that such shares will be counted for purposes of determining whether a quorum is present at the Meeting).

Instructions on how to access Sensient’s proxy materials and our 2022 Annual Report on Form 10-K via the Internet and how to vote can be found in the Notice made available to our shareholders of record and beneficial owners and on the proxy card.

IF YOU HAVE ANY QUESTIONS OR NEED ASSISTANCE WITH VOTING,

PLEASE CONTACT OUR PROXY SOLICITOR,

D.F. KING & CO., INC.,

TOLL FREE AT (888) 887-0082.

SENSIENT TECHNOLOGIES CORPORATION

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

(414) 271-6755

Proxy Statement

For the Annual Meeting of Shareholders

Shareholders to be held on

April 23, 2020

27, 2023

GENERAL

This proxy statement and proxy are furnished to the shareholders of Sensient Technologies Corporation, a Wisconsin corporation (“Company”(the “Company” or “Sensient”), in connection with the solicitation by the Board of Directors of the Company (“Board”(the “Board”) of proxies for use at the Company’s 20202023 Annual Meeting of Shareholders, and at any adjournments thereof (“Meeting”(the “Meeting”), for the purposes set forth in the Notice of Annual Meeting and in this proxy statement. The Meeting will be held at the Westin Milwaukee, 550 North Van Buren Street, Milwaukee, Wisconsin, on Thursday, April 23, 2020,27, 2023, at 8:00 a.m., Central Time.

As permitted under Securities and Exchange Commission (“SEC”) rules, the Company is once again making this proxy statement and other annual meeting materials available on the Internet instead of mailing a printed copy of these materials to each shareholder. Most shareholders will receive a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail and will not receive a printed copy of these materials (other than Sensient’s benefit plan participants that have not received notice of default electronic delivery and other shareholders who request a printed copy as described below). Instead, the Notice contains instructions as to how shareholders may access and review all of the important information contained in Sensient’s proxy materials on the Internet, and how shareholders may submit proxies by mail, by telephone, or over the Internet. The Notice is being mailed to shareholders, and the proxy materials will be available on the Internet, beginning on or about March 6, 2020.

15, 2023.

If you would prefer to receive a printed copy of the Company’s proxy materials, please follow the instructions for requesting printed copies included in the Notice.

The form of proxy solicited by the Board for the Meeting, this proxy statement, the Notice of Annual Meeting, and the 20192022 Annual Report on Form 10-K (“20192022 Annual Report”), are available on our website at http://investor.sensient.com. The 2019 Annual Report contains financial statements for the three years ended December 31, 2019, and certain other information concerning the Company. The Company will provide copies of the exhibits to the 20192022 Annual Report to shareholders upon request. The 20192022 Annual Report and financial statements are neither a part of this proxy statement nor incorporated herein by reference.

Who can vote?

Only holders of record of the Company’s Common Stock, par value $0.10 per share (“Common Stock”), as of the close of business on February 26, 2020,March 1, 2023, are entitled to notice of, and to vote at, the Meeting. On that date, the Company had 42,326,81742,226,406 shares of Common Stock outstanding, each of which is entitled to one vote on each proposal submitted for shareholder consideration at the Meeting.

How will proxies be voted?

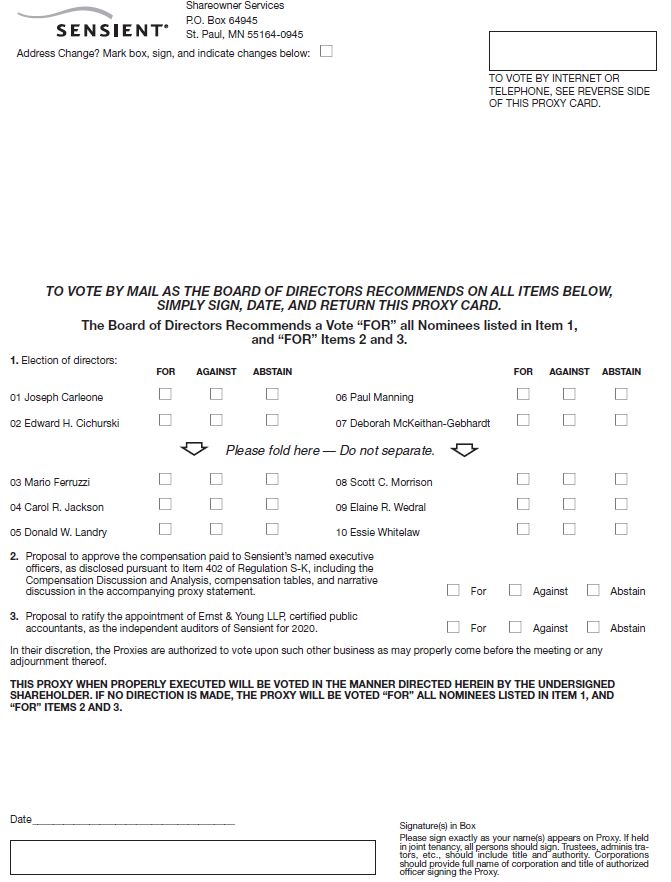

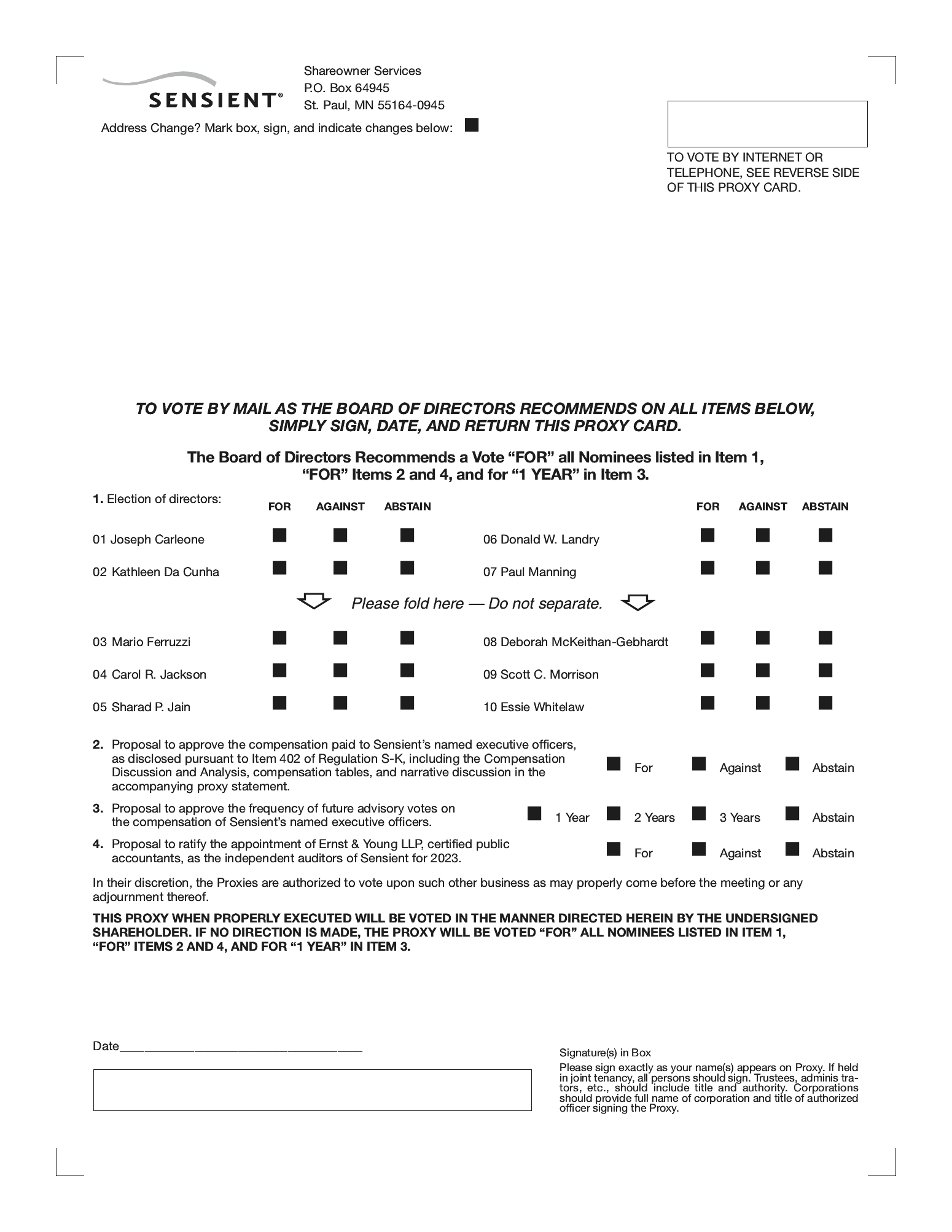

Subject to the applicable New York Stock Exchange regulations regarding discretionary voting by brokers as described below, a proxy that is (1) properly executed; (2) duly transmitted via mail, telephone, or Internet to the Company or its authorized representatives or agents; and (3) not revoked, will be voted in accordance with the shareholder’s instructions contained in the proxy. If no instructions are indicated on the executed proxy, the shares represented thereby will be voted as follows:

FOR the election of the Board’s ten nominees for director;

FOR approval of the compensation of our named executive officers, as disclosed herein pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and narrative discussion in this proxy statement;

1

that the advisory shareholder vote concerning our executive compensation be held every 1 YEAR;

FOR ratification of the Board’s appointment of Ernst & Young LLP as the Company’s independent auditors for 2020;2023; and

On such other matters that may properly come before the Meeting in accordance with the best judgment of the individual proxies named in the proxy.

How are Broker non-votes handled?

Brokers are not entitled to vote on the election of directors, on the advisory shareholder vote on our executive compensation, or on any other matter relating tothe frequency of shareholder advisory votes concerning our executive compensation unless they receive voting instructions from the beneficial owner, but they will be able to vote with respect to ratification of Ernst & Young LLP as our auditors for 2020.2023. If a broker does not receive voting instructions from the beneficial owner, the broker may return a proxy card with no vote on thesethe matters that the broker is not entitled to vote on, which is generally referred to as a broker non-vote. The shares subject to a broker non-vote will be counted for purposes of determining whether a quorum is present at the Meeting if the shares are represented at the Meeting by proxy from the broker. A broker non-vote will have no effect with respect to the election of directors, the advisory shareholder vote on our executive compensation, or any other matter related to executive compensation.

the frequency of holding such advisory votes.

What if I hold shares through multiple entities?

Shares held in the same registration (for example, shares held by an individual directly and through an employee benefit plan) will be combined onto the same proxy card whenever possible. However, shares held with different registrations cannot be combined and, therefore, a shareholder may receive more than one proxy card. If you hold shares in multiple accounts with different registrations, you must vote each proxy card you receive to ensure that all shares you own are voted in accordance with your directions.

What if I want to change or revoke my proxy?

Any record shareholder giving a proxy may revoke it at any time before it is exercised at the Meeting by delivering written notice thereof to the Secretary of the Company or by transmitting a later-executed proxy.proxy (including by telephone or by Internet) or by voting in person at the Meeting. If you are a beneficial holder (that is, if your shares are held through your bank or broker), you must contact your bank or broker to determine how to revoke your voting instructions.

Can I vote at the Annual Meeting?

Any record shareholder attending the Meeting may vote in person whether or not the shareholder has previously filed a proxy. Attending the Meeting and voting in person revokes a previously filed proxy, but presence at the Meeting by a shareholder who has signedsubmitted a proxy does not in itself revoke the proxy.

If you are a beneficial holder and you would like to vote at the Meeting, please contact your bank, broker, or other nominee to request a legal proxy. Please note that you will not be able to vote your shares at the Meeting without a legal proxy. You will need to ask your bank, broker, or other nominee to furnish you with a legal proxy.

Who is paying for the proxy process?

The cost of soliciting proxies will be borne by the Company. The Company will use the services of D. F.D.F. King & Co., Inc., New York, New York, to aid in the solicitation of proxies. SensientThe Company expects that it will pay D. F.D.F. King & Co., Inc., its customary fees, estimated not to exceed approximately $10,500$11,000 in the aggregate, plus reasonable out-of-pocket expenses incurred in the process of soliciting proxies. The Company will also reimburse brokerage houses and other custodians, nominees, and fiduciaries for their expenses in sending proxy materials to beneficial owners.

Will anyone be contacting me about my proxy vote?

Proxies may be solicited by directors, officers, or employees of the Company or D.F. King, in person, by telephone, or by Internet.

2

| ITEM 1. | ELECTION OF DIRECTORS |

All directors are elected on an annual basis for one-year terms. The Board currently consists of eleventen members. Mr. Brown, whoDue to her desire to retire, Dr. Wedral is currently serving as a director will be retiring and not seeking re-election to the Board. AfterUpon the meeting,recommendation of the Nominating and Corporate Governance Committee, the Board will decreasenominated Kathleen Da Cunha to fill the sizevacancy created as a result of Dr. Wedral’s retirement. Ms. Da Cunha was recommended to the BoardNominating and Corporate Governance Committee by the Company’s management following an internal recruiting search process that included recommendations from eleven to ten members in accordance with Sensient’s Amended and Restated By-laws (“By-laws”).shareholders. The Board has re-nominated theits other ten of itsnine current directors: Messrs. Cichurski,Jain, Paul Manning, and Morrison; Drs. Carleone, Ferruzzi, Landry, and Wedral;Landry; and Mses. Jackson, McKeithan-Gebhardt, and Whitelaw.

The Company intends that the persons named as proxies on the proxy cards will vote FOR the election of the Board’s ten nominees if executed but unmarked proxies are returned (excluding broker non-votes). If any nominee should become unable to serve as a director prior to the Meeting, the shares represented by proxy cards that include directions to vote in favor of that nominee or that do not contain any other instructions (excluding broker non-votes) will be voted FOR the election of such other person as the Board may recommend, subject to the rules for broker non-votes described under the section entitled “GENERAL,” above.

recommend.

Sensient’s Amended and Restated Articles of Incorporation provide that directors shall be elected by a majority of the votes cast by the shares entitled to vote at a meeting at which a quorum is present except in a contested election of directors. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes cast “against” with respect to that director’s election. Any director who is not reelected by a majority of the votes cast in an uncontested election shall tender his or her resignation to the Board, and the Board will determine, with the recommendation of the Nominating and Corporate Governance Committee, whether to accept or reject the resignation.

Brokers do not have discretion to cast votes in the election of directors with respect to any shares for which they have not received voting directions from their beneficial owners. Broker non-votes and abstentions will not affect the outcome of this proposal.

Under the Company’s By-laws,Amended and Restated By-Laws (“By-laws”), written notice of other qualifying nominations by shareholders for election to the Board, together with a completed Directors and Executive Officers Questionnaire, affirmation, consent, and certain other materials as specified in the Company’s By-laws, must have been received by the Secretary no later than 90 days before the Meeting, or January 24, 2020.27, 2023. As no notice of any other nominations was received, no other nominations for election to the Board may be made by shareholders at the Meeting.

Director Selection Criteria; Director Qualifications and Experience

The Company’s Director Selection Criteria are attached as Appendix A to this proxy statement and is also available on the Company’s website. These criteria are periodically reviewed by the Nominating and Corporate Governance Committee. The criteria require independence and an absence of material conflicts of interest of all independent and non-management directors. The criteria also describe the personal attributes and the broad mix of skills and experience of directors sought by the Company in order to enhance the diversity of perspectives, professional experience, education, and other attributes, and the overall strength of the composition of the Board. The skills and experience that we consider most important for membership on the Board include a background in at least one of the following areas:

substantial recent business experience at the senior management level, preferably as chief executive officer;

a recent leadership position in the administration of a major college or university;

recent specialized expertise at the doctoral level in a science or discipline important to the Company’s business;

recent prior senior level governmental or military service;

financial expertise; or

risk assessment, risk management, or employee benefit skills or experience.

Below, we describe the particular skills, experience, qualifications, and other attributes that the Board believes qualify each of Sensient’s nominees to serve on the Board.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR ALL TEN NOMINEES DESCRIBED BELOW. SHARES OF COMMON STOCK REPRESENTED AT THE MEETING BY EXECUTED BUT UNMARKED PROXIES (EXCLUDING BROKER NON-VOTES) WILL BE VOTED FOR ALL TEN NOMINEES DESCRIBED BELOW.

3

| ||

Our director nominees are ten talented individuals with diverse skillsets and backgrounds, as reflected in their biographies set forth below. Four director nominees are women, one of AMPAC Fine Chemicals LLC,whom is African American. One director nominee is a leading manufacturer of pharmaceutical active ingredients

| ||

| ||

| ||

| ||

The table below summarizes the key skills and expertise that we consider important for our director nominees considering our business strategy. A mark indicates a specific area of focus or expertise on Bioethics duringwhich the George W. Bush administration

| | Skills and Expertise | | | Carleone | | | Da Cunha | | | Ferruzzi | | | Jackson | | | Jain | | | Landry | | | Manning | | | McKeithan Gebhardt | | | Morrison | | | Whitelaw | |

| | CEO or senior officer of business, university, governmental, or military organization | | | • | | | • | | | | | • | | | | | • | | | • | | | • | | | • | | | • | | ||

| | International experience | | | • | | | • | | | • | | | • | | | • | | | | | • | | | | | • | | | | |||

| | Human capital management experience | | | • | | | | | | | • | | | • | | | | | • | | | | | • | | | • | | ||||

| | Compensation program experience or expertise | | | • | | | | | • | | | • | | | • | | | | | • | | | | | • | | | • | | |||

| | Risk assessment or risk management experience or expertise | | | • | | | | | | | • | | | • | | | | | • | | | • | | | • | | | • | | |||

| | Financial literacy | | | • | | | | | | | • | | | • | | | | | • | | | • | | | • | | | • | | |||

| | Chemistry or food science experience or expertise | | | | | • | | | • | | | | | | | • | | | • | | | | | | | | ||||||

| | Sustainability experience or expertise | | | | | | | | | • | | | | | | | | | | | • | | | | ||||||||

| | Corporate governance experience | | | • | | | | | | | • | | | • | | | | | • | | | • | | | • | | | • | | |||

| | Age/Tenure/Sex/Veteran | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Age | | | 77 | | | 61 | | | 48 | | | 50 | | | 63 | | | 68 | | | 48 | | | 64 | | | 60 | | | 74 | |

| | Board Tenure | | | 9 | | | – | | | 8 | | | 4 | | | 2 | | | 8 | | | 11 | | | 9 | | | 7 | | | 30 | |

| | Sex | | | M | | | F | | | M | | | F | | | M | | | M | | | M | | | F | | | M | | | F | |

| | Veteran | | | | | | | | | | | | | | | • | | | | | | | | |||||||||

| | Race/Ethnicity/Nationality | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | African American/Black | | | | | | | | | | | | | | | | | | | | | • | | |||||||||

| | Asian/South Asian | | | | | | | | | | | • | | | | | | | | | | | | |||||||||

| | White/Caucasian | | | • | | | • | | | • | | | • | | | | | • | | | • | | | • | | | • | | | | ||

| | Hispanic/Latino | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Native American | | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | Born Outside of the U.S. | | | | | | | • | | | | | • | | | | | | | | | | | |

4

| | | Age | | | Director Since Lead Director Audit Committee Compensation and Development Committee (Chairman) Executive Committee Scientific Advisory Committee |

| | | Professional Experience: • Senior Advisor (2018-present) of OES Europe, an independent advisory network specializing in strategic cross-border mergers & acquisitions and in management buy-outs. • Non-executive Chairman, Avid Bioservices, Inc. (2017-present), a biopharmaceutical manufacturing company focused on mammalian cell technology to support the pharmaceutical industry • Chairman of the Board (2015-2018) of AMPAC Fine Chemicals LLC, a leading manufacturer of pharmaceutical active ingredients • President and Chief Executive Officer (2010-2015), President and Chief Operating Officer (2006-2009), and Chairman of the Board (2013-2014) of American Pacific Corporation, a leading custom manufacturer of fine and specialty chemicals and propulsion products Other Recent Public Company Directorships: • American Pacific Corporation (2006-2015) Other Experience: • Drexel University, B.S., Mechanical Engineering • Drexel University, M.S., Applied Mechanics • Drexel University, Ph.D., Applied Mechanics Qualifications: • Operational, governance, management, and scientific experience, including as Chief Executive Officer and as Chairman of a public corporation with international operations in the fine and specialty chemical industries. | ||||

| | |||||

| Age 61 | | | Director Since | ||

| | | Professional Experience: • Vice President, Research & Development, Fresh Dairy Direct at Dean Foods Company (2010-2012) • Vice President, Research & Development, PepsiCo Latin America Beverages (2008-2009), Vice President, Research & Development, Gatorade North America (2006-2008), Senior Director, Product Development, Non-Carbonated Beverages, PepsiCo International (2005-2006), Director, Product Development, Global Flavored Carbonated Soft Drinks (2001-2005), Senior Manager, R&D, Quality and Operations, The Pepsi Lipton Tea Partnership (1998-2001), and Manager, Product Development, Global Lemon Lime Products (1996-1998) at PepsiCo, Inc. • Group Leader, Color Cosmetics (1993-1996) and Senior Research Chemist, Color Cosmetics (1986-1993) at Estée Lauder Inc. Other Recent Public Company Directorships: • None Other Experience: • Bates College, B.S. in Chemistry • University of Connecticut, M.B.A in Marketing/International Business • The Wharton School, University of Pennsylvania, Executive Education Certificate – Strategic Thinking and Management for Competitive Advantage • Holds four patents as inventor or co-inventor relating to beverage systems and cosmetic compositions Qualifications: • R&D expertise with substantial business and personnel management and leadership experience in developing innovative and commercially successful food, beverage, and personal care products; and • Extensive industry experience, including extensive experience with product development and commercialization. | ||||

6

| | | Dr. Mario Ferruzzi Age 48 | | | Director Since 2015 Compensation and Development Committee Nominating and Corporate Governance Committee Scientific Advisory Committee |

| | | Professional Experience: • Director of the Arkansas Children’s Nutrition Center and Professor and Chief, Section of Developmental Nutrition in the Department of Pediatrics at the University of Arkansas for Medical Sciences (2021-present) • Endowed Chair in Digestive Disease & Nutrition Research at Arkansas Children’s Research Institute (2022-present) • David H. Murdock Distinguished Professor (2019-2021), and Professor of Food Science and Nutrition (2016-2019) in the Plants for Human Health Institute and the Department of Food, Bioprocessing and Nutrition Science at North Carolina State University • Professor in the Department of Food Science at Purdue University (2004-2016) • Research Scientist positions in the Coffee and Tea Beverage Development group at Nestlé Research & Development Center, Marysville, Ohio, and the Nutrition & Health and Scientific & Nutritional Support Departments at the Nestlé Research Centre in Lausanne, Switzerland (2001-2004) Other Recent Public Company Directorships: • None Other Experience: • Duke University, B.S. in Chemistry • The Ohio State University, M.S. and Ph.D. in Food Science and Nutrition • Expertise in analytical chemistry and its applications to food and nutrition research and product development • Research consistently funded by federal agencies including the U.S. Department of Agriculture, the National Institutes of Health, and the United States Agency for International Development, as well as the food industry • Over 208 publications as well as extensive experience with national and international collaborations, research, and product development • Recipient of numerous research awards from the Institute of Food Technologists (IFT) (2010 Samuel Cate Prescott Young Investigator Award), the American Society for Nutrition (ASN) (2011 Mary Rose Swartz Young Investigator Award), Purdue University (2012 Agricultural Research Award), the General Mills Bell Institute of Health and Nutrition (2018 Innovation Award), and IFT/ASN (2019 Gilbert A. Leveille Award and Lectureship) • Named a University Faculty Scholar by Purdue University in 2013 • Member of the Board of Trustees for the North America branch of the International Life Science Institute • Professional member of IFT, ASN, and the American Chemical Society (ACS) • Fellow of the Royal Society of Chemistry • Chair (2014) of the Food Science & Nutrition Solutions Taskforce, a joint working group between IFT-ASN-IFIC and the Academy of Nutrition and Dietetics (AND) • Serves on the editorial boards of Nutrition Research, Nutrition Today, and Critical Reviews in Food Science and Nutrition • Associate Editor for the Royal Society of Chemistry’s journal, Food & Function Qualifications: • Expert in analytical chemistry and its application to food and nutrition; • Extensive industry and academic experience, including extensive experience with new product development and product commercialization; and • Extensive international research collaborations and experience in Europe, Asia, Africa, and Latin America. | ||||

7

| | | Age | | | Director Since Audit Committee Scientific Advisory Committee |

| | | Professional Experience: • Chairman, President, and Chief Executive Officer (2017-2023) and Corporate Officer, Senior Vice President, and General Manager (2014-2017) of HarbisonWalker International • Corporate Officer, Vice President (GM), Carpenter Technology Corporation (2011-2013); Managing Director, Global Raw Materials Purchasing (2009-2011), General Manager Global Powder Coatings (2007-2009), Commercial Segment Manager Architectural Coatings (2005-2006), Global Sales Account Manager Automotive OEM Glass (2002-2005), Global Sales Account Manager Consumer Electronics Coatings (2001-2002), Market Development Manager (1999-2001) at PPG Industries Other Recent Public Company Directorships: • AZZ Inc. (2021-present), a global provider of metal coating solutions, welding solutions, specialty electrical equipment and highly engineered services Other Experience: • Duquesne University, B.S. in Business Administration • University of Pittsburgh, Juris Doctorate • Carnegie Mellon University, M.S. in Industrial Administration (M.B.A.) • Yale School of Management Executive Education Program • Certified Transformative Mediator • Director and Member of Governance Committee (2014-present), Junior Achievement of Western Pennsylvania • Licensed attorney (1999-present) Pennsylvania • Business Process Improvement Green Belt • Women’s Leadership Council and Impact Fund Committee, United Way Qualifications: • Extensive management experience in private and public enterprises, including public corporations with extensive manufacturing, international operations, and chemical businesses, and leadership experience as a Chief Executive Officer; and • Experience in business roles including management, sales, marketing, procurement, acquisitions, and business development. | ||||

| | | Age | | | Director Since Finance Committee |

| Scientific Advisory Committee | |||||

| | | Professional Experience: • More than 33 years practicing as a certified public accountant with PricewaterhouseCoopers (retired in 2020) providing audit and advisory services to global companies engaged in consumer and industrial products businesses • Served as the Global and U.S. Automotive Assurance Sector Leader (2012-2015) and senior partner in the Governance Insights Center (2018-2020) with PricewaterhouseCoopers • Significant global experience including mature and emerging markets Other Recent Public Company Directorships: • None Other Experience: • Certified Public Accountant (1987); Elijah Watt Sells Award recipient • Chartered Institute of Taxation, United Kingdom (1984) • Fellow of The Institute of Chartered Accountants in England and Wales (1983) • Hull College of Higher Education, United Kingdom (1979) Qualifications: • Accounting and auditing experience and expertise, including extensive experience auditing global companies as a certified public accountant; • Business experience, both at a senior leadership level and as an advisor to companies in a variety of consumer and industrial products businesses; and • Regulatory compliance and human capital management experience. | ||||

9

| | | Dr. Donald W. Landry Age 68 | | | Director Since 2015 Compensation and Development Committee Nominating and Corporate Governance Committee (Chairman) Scientific Advisory Committee |

| | | Professional Experience: • Member of the faculty of Columbia University (1985-present) • Professor and Chair of the Department of Medicine at Columbia University’s College of Physicians and Surgeons (2008-present) • Director of the Division of Experimental Therapeutics and Physician-in-Chief for the Medical Service at New York Presbyterian Hospital/Columbia Medical Center • Founding director of Tonix Pharmaceuticals, Inc., a wholly-owned subsidiary of Tonix Pharmaceuticals Holding Corp. (2007-2011) • Co-founder of Vela Pharmaceuticals, a private company that developed several drugs for central nervous system disorders, including very low dose (VLD) cyclobenzaprine for fibromyalgia syndrome • Co-founder of Tegrigen Therapeutics, LLC, a private company that developed novel therapeutics for inflammation, fibrosis, thrombosis, autoimmunity, and cancer based on pure orthosteric antagonists to specific integrins. • Co-founder of Omnitia Therapeutics Inc., a private company that developed novel therapeutics for neurodegenerative diseases based on small molecule antagonists to stress granule formation. Other Recent Public Company Directorships: • Tonix Pharmaceuticals Holding Corp. (2011-2019), a pharmaceutical company that develops next-generation medicines for common disorders of the central nervous system, including fibromyalgia, post-traumatic stress disorder, and episodic tension-type headache Other Experience: • Lafayette College, B.S. in chemistry (1975) • Harvard University, Ph.D. in organic chemistry (1979) • Columbia University’s College of Physicians and Surgeons, M.D. (1983) • Developed the first artificial enzyme to degrade cocaine and his report in Science was voted one of top 25 papers in the world for 1993 by the American Chemical Society • Discovered that vasopressin can be used to treat vasodilatory shock, which fundamentally changed intensive care practice for this condition • Pioneered an embryo-sparing approach to the generation of human embryonic stem cells • Served as a member of the President’s Council on Bioethics during the George W. Bush administration • Awarded the Presidential Citizens Medal, the nation’s second-highest civilian award (2008) • Elected to the National Academy of Inventors (2016) • National Institutes of Health (NIH) Physician-Scientist, Columbia University (1985-1990) • Published 116 peer-reviewed articles, authored 33 review articles or book chapters, and awarded 51 patents as inventor or co-inventor Qualifications: • Expert in the medical and pharmaceutical fields and has unique experiences in the formation, operation, and public registration of a start-up pharmaceutical company; and • Experience as director of a public corporation; experience in commercialization of new products and in research and development; strong technical acumen in chemistry, medicine, and the pharmaceutical industry and other fields related to our business; and academic background. | ||||

10

| | | Paul Manning Age 48 | | | Director Since 2012 Executive Committee (Chairman) Finance Committee Scientific Advisory Committee |

| | | Professional Experience: • Chairman, President and Chief Executive Officer of Sensient Technologies Corporation (2016-present) • Formerly President and Chief Executive Officer (2014-2016), President and Chief Operating Officer (2012-2014), President, Color Group (2010-2012), and General Manager, Food Colors North America (2009-2010) of Sensient Technologies Corporation • Mergers and Acquisitions Integration Manager of the Fluke Division of Danaher Corporation • Various supply chain and project manager positions with McMaster-Carr Supply Company Other Recent Public Company Directorships: • None Other Experience: • Stanford University, B.S. in Chemistry • Northwestern University, M.B.A. • Attended Stanford University on a Naval ROTC scholarship • Served in the U.S. Navy as a Surface Warfare Officer for four years Qualifications: • Responsible for articulating and executing the Company’s strategy, upgrading of sales force and general manager talent, and leading the Board of Directors; • Extraordinarily detailed knowledge of the Company’s operations enables him to keep the Board well informed regarding the Company’s performance and opportunities; • Strong background in chemistry allows him to direct product and technology research and development efforts; and • Prior experience in mergers and acquisitions and supply chain management. | ||||

11

| | | Deborah McKeithan-Gebhardt Age 64 | | | Director Since 2014 Finance Committee (Chairman) Nominating and Corporate Governance Committee Scientific Advisory Committee |

| | | Professional Experience: • Manager, Troika Ventures, LLC, a private limited liability company engaged in the management, purchase, and sale of oil and gas overriding royalty and royalty interests (2021-present). • Chief Executive Officer, President, and Chief Operating Officer of Tamarack Petroleum Company, Inc., a private company engaged in oil and gas exploration and operation (2019-2021) • Chief Executive Officer of Tamarack River Resources, LLC, a Delaware limited liability company of which Tamarack Petroleum was the majority member (2009-2021) • Previously President and Chief Operating Officer of Tamarack Petroleum Company, Inc. (2009-2019), and Vice President and General Counsel of Tamarack Petroleum Company, Inc. (1991-2009) Other Recent Public Company Directorships: • None Other Experience: • Cardinal Stritch University, B.S. in Business Administration (1980) • Marquette University Law School, Juris Doctor degree, summa cum laude (1987) • Marquette University Law School Advisory Board Qualifications: • As a former Chief Executive Officer, President, and Chief Operating Officer, and also previously as Vice President and General Counsel, had primary responsibility for, and extensive experience in, a range of strategic and operational matters, including strategic planning, risk management, financial management, human resources, compensation and employee benefits, regulatory and compliance, and legal affairs. | ||||

12

| | | Scott C. Morrison Age 60 | | | Director Since 2016 Audit Committee (Chairman) Compensation and Development Committee Executive Committee Scientific Advisory Committee |

| | | Professional Experience: • Executive Vice President and Chief Financial Officer of Ball Corporation, a leading global supplier of innovative, sustainable packaging solutions for beverage, food, and household products customers (January 2021-present) • Senior Vice President and Chief Financial Officer of Ball Corporation (2010-2021) • Vice President and Treasurer of Ball Corporation (2000-2010) • Various senior corporate banking roles at Bank One, First Chicago, and NBD Bank, Detroit Other Recent Public Company Directorships: • None Other Experience: • Indiana University, B.S. in Finance (1984) • Wayne State University, M.B.A. (1988) • Executive Committee Member of the Board for the National Association of Manufacturers • Past Community Chairman of the Denver Chapter of the Kelley School of Business Indiana University • Served as Chairman of the National Association of Corporate Treasurers • Expert testimony witness to the U.S. House of Representatives Agricultural Committee on Dodd-Frank legislation • Recognized as CFO of the Year by CFO Magazine and Institutional Investor Qualifications: • Possesses a wealth of valuable leadership experience and financial expertise, gained through currently serving as Chief Financial Officer of a publicly traded multinational corporation and having served in various other executive management and senior corporate banking roles; • Significant experience in mergers and acquisitions and post-merger integration, including Ball Corporation’s $6.1 billion acquisition and integration of Rexam PLC, a metal beverage packaging manufacturer; and • Experience, expertise, and background in capital allocation, financial reporting, international, and compliance matters. | ||||

13

| | | Essie Whitelaw Age 74 | | | Director Since 1993 Executive Committee Scientific Advisory Committee |

| | | Professional Experience: • Senior Vice President of Operations, Wisconsin Physician Services, a provider of health insurance and benefit plan administration (2001-2010) • Served over 15 years in various executive positions, including as President and Chief Operating Officer (1992-1997) and Vice President of National Business Development, at Blue Cross Blue Shield of Wisconsin, a comprehensive health and dental insurer Other Recent Public Company Directorships: • None Other Experience: • Served on the board and on the audit, nominating, and retirement plan investment committees of WICOR Corporation, a Wisconsin energy utility, prior to its merger into another public utility in 2000 • Director (2016-current) of Network Health, a Wisconsin based private health insurer • Current nonprofit board service to the Kingdom Prep Lutheran School and the Wisconsin Women’s Health Foundation, a non-profit organization dedicated to improving the health and lives of women and their families through education, outreach programs, and partnerships • Prior nonprofit board service to the Milwaukee Public Museum, Goodwill Industries, United Way of Greater Milwaukee, Blue Cross Blue Shield Foundation, Metropolitan Milwaukee Association of Commerce, Greater Milwaukee Committee, and Bradley Center Sports and Entertainment Corp. Qualifications: • Significant regulatory compliance and human resources experience, including developing and implementing compensation policies and designing incentive programs for sales and customer service employees to achieve business objectives while managing risk; and • Nearly thirty years of service on the Company’s Board provides exceptionally deep insights into the Company, its history, and operations. | ||||

Except as noted, all nominees have held their current positions or otherwise have served in their respective positions with the listed organizations for more than five years. No director or nominee for director had any material interest, direct or indirect, in any business transaction of the Company or any subsidiary since the beginning of 2019,2022, nor does any director or nominee have any material interest, direct or indirect, in any such proposed transaction. Ms. Da Cunha, a director nominee for the Company, is Senior Vice President, Research & Development and Strategy at Ruiz Foods. In the ordinary course of business, the Company sold ingredients to Ruiz Foods in 2022. In addition, Mr. Paul Manning (Chairman, President, and Chief Executive Officer) and Mr. John J. Manning (Senior Vice President, General Counsel, and Secretary) are brothers. See “Transactions with Related Persons” below. The Board has determined that all members of the Board, except Mr. Paul Manning and Ms. Whitelaw, are independent under the applicable rules of the New York Stock Exchange and the Securities and Exchange Commission (the “SEC”). See “Corporate Governance - Director Independence” below.

Corporate Governance

Board Role in Risk Oversight

The Board is responsible for exercising the corporate powers of the Company and overseeing the management of the business and affairs of the Company, including management’s establishment and implementation of key strategic priorities and initiatives. The Board reviews and approves the Company’s Strategy annually and conducts formal strategic reviews at each meeting. Long-term, sustainable value creation and preservation are possible only through the prudent assumption and management of both risks and potential rewards, and Sensient’sthe Company’s Board takes a leading role in overseeing the Company’s overall risk tolerances as a part of the strategic planning process and in overseeing the Company’s management of strategic risks. The Board has delegated to the Audit Committee primary responsibility for overseeing management’s risk assessments and implementing appropriate risk management policies and guidelines, including those related to financial reporting and regulatory compliance. It has delegated to the Compensation and Development Committee primary oversight responsibility to ensure that compensation programs and practices do not encourage unnecessary or excessive risk-taking and that any risks are subject to appropriate controls. It has delegated to the Nominating and Corporate Governance Committee primary oversight responsibility to ensure that the Company’s governance standards establish effective systems for monitoring and accountability, andaccountability; the Committee also oversees the Company’s sustainability efforts and reviews and approves the Company’s Corporate ResponsibilitySustainability Report. ItThe Board has delegated to the Finance Committee primary oversight responsibility with respect to Sensient’sthe Company’s capital structure, insurance program, use of swaps and other derivative instruments, and foreign currency management. The Board has assumed direct responsibility for Human Capital Management and the Company’s cybersecurity program.

product safety, personnel safety, physical security, human capital management, and cyber and intellectual property security programs.

Additionally, all directors, along with fourfive non-director members who are recognized food science or food safety experts, participate in the Scientific Advisory Committee, which monitors and reviews new product development programs, industry trends, and technical and regulatory issues related to Sensient’sthe Company’s product lines. The Board and these committees receive periodic reports on these matters from management and the Company personnel in charge of the related risk management activities. Furthermore, the Board has direct access to all electedexecutive officers of the Company and routinely receives presentations from Group Presidents, General Managers of various business units, technical leaders, and product safety leaders.

Corporate Code of Conduct (available in all languages used within the Company), which includes:

Antitrust Compliance Manual

Anti-Bribery Policy

Company Confidential Information Policy

Cybersecurity Policyprinciples

Insider Trading Policy

Supplier Code of Conduct

Securities Compliance Manual

Cybersecurity Policy

Global Privacy Policy

Export Compliance Policy

Food Safety/Recall Manual

Physical Security Policy

15

The boardBoard has also implemented, formalized, and updated internal policies and compliance programs with respect to various regulatory matters, including Environmental, Health, and Safety (EHS)(“EHS”) and intellectual property management.

In addition to providing annual Company-wide training on the Code of Conduct, the Board has ensured that targeted training on each of the other compliance programs is conducted for all appropriate employees. The Code of Conduct includes, among many other rules, strict integrity, professionalism, safety, and personnel policies to prevent harassment, discrimination, and retaliation, as well as strong and routinely publicized violation reporting protocols. Additionally, the Audit Committee receives a quarterly update from the General Counsel on all reported Code of Conduct violations, which includes a summary of every investigation conducted of an alleged Code of Conduct violation and the disposition of each investigation. To ensure all employees understand the importance of the Code of Conduct, violations and dispositions are also reviewed with employees and the CEO publishes an internal blog to all employees explaining each violation and emphasizing the importance of adhering to the Code.

The Board oversees a robust program related to Product Safety,product safety, including the following elements:

The Board receives a report on food and personnel safety related issues at each meeting.

All potential product safety issues are reported immediately to the CEO, and the Company’s head of product safety and quality is a direct report of the CEO. In 2021, the Board formalized an existing practice of the CEO reporting of product safety issues to the Board in a written policy, which sets forth specific reportable events and a timeline for required Board notification when a product safety issue occurs.

The Company has established guidelines for Good Manufacturing Practices (GMP) and Hazard Analysis and Critical Control Points (HACCP), and, since 1999, conducts comprehensive product safety audits, including GMP/HACCP audits, at all of its food ingredient manufacturing facilities.

Comprehensive and robust raw material approval processes are in place to ensure product safety.

Raw materials and finished goods are analyzed for compliance with specifications prior to use and shipment, respectively.

The Company conducts key vendor quality assurance inspections directly or by third-party accredited auditing organizations.

The Company develops and implements corrective action plans for all internal, customer, and third-party audit deficiencies.

The Company monitors industry violations and shares details of such violations with its customers.

The Board oversees the Company’s Human Capital Management program, including the following elements:

The Company seeks to benefit from the full spectrum of human talent, hiring the best talent and reflecting the needs of our customers and the communities in which we operate. To this end, the Company has a dedicated, internal Talent Acquisition team, which sources talent from a broad range of backgrounds and utilizes emerging technology, guided by a deep understanding of the Company’s business objectives and core values of integrity, professionalism, and safety.

The Company closely monitors and demands excellence in its on-boarding process, to ensure all new hires have the tools, training, Company knowledge, and management support necessary to succeed in the organization from day one.

The Company maintains and reviews annually its compensation and benefit programs, to confirm that it is providing market-competitive offerings designed to reward high performers and retain talent.

The Company conducts succession planning organization-wide on an annual basis to evaluate the pipeline for leadership roles and implement development plans for key talent.

The Company utilizes internal development programs such as the Sales Representative Trainee Program, the General Management Development Program, the Flavorist Trainee Program, and the High Potential Program to provide a robust internal pipeline of talent for high impact roles in the organization.

16

The Company facilitates the development and progression of its workforce through goal setting, performance evaluations, individual development plans, leadership training, and ongoing individualized coaching and development.

The Company regularly communicates and rigorously enforces its non-negotiable expectations of integrity, professionalism, and safety, which encompass an unwavering commitment to equal opportunity and non-discrimination, and which underpin the Company’s strategy to draw from the fullest set of talent possible.

| • | Under the Company’s Code of Conduct, a Company lawyer (or designated outside counsel outside the U.S.) must review and approve all employee terminations to ensure they are warranted and compliant with all applicable laws. |

The Board of Directors receives a reportreviews the Company’s Human Capital Management program on food and personnel safety related issues at each meeting.

an annual basis.

The Board oversees the Company’s Cybersecurity Program, including the following elements:

The Board has defined high-risk cybersecurity areas for the Company and implemented comprehensive programs to address these risks.

Management reports at least twice annually to the Board of Directors on cybersecurity progress and effectiveness.

The Company has formed an executive level steering committee (including the CEO, CFO, Group Presidents, General Counsel, VP, of Human Resources, Controller/Chief Accounting Officer, and Chief Information Officer) that provides oversight and meets monthly.routinely discusses cybersecurity matters.

The Company has implemented an annual employee training program, quarterlyregular cyber executive incident response simulations, and regular cyber and physical penetration testing.

The Company has made significant investments in its technical capabilities in all areas of security.

The Board, through the Audit Committee, oversees a number of activities undertaken by management to monitor financial reporting risks and internal control.controls. Those activities include regular audits of significant business units by the Company’s Internal Audit Department, annual audit and quarterly reviews by Ernst & Young LLP, an annual internal control audit by Ernst & Young LLP, and, when needed, special investigations directed by the Vice President,Director, Internal Audit and General Counsel of any unusual or irregular activities.

The Board also oversees other Company programs in order to monitor and limit legal and regulatory risks, including:

Chemical Risk Reduction Strategy, led by the CEO and DirectorDirectors Drs. Wedral and Ferruzzi and SAC member Dr. Wedral,Eric Decker, which includes improved product warnings and enhanced safety protocols, as well as forward looking risk identification and product elimination;

A corporate physical security program led by a retired Secret Service Agent, who reports to the General Counsel;

A robust Environmental, Health, and Safety (EHS)EHS program that is managed within the Legal Department;

A strong Regulatory Affairs department overseen by a Vice President who reports to the General Counsel;

In-house securities attorney;

In-house compliance attorney who is continually engaged with the business units on FDA, EPA, and OSHA regulatory matters; and

Legal Department review of all contracts; and

Board Meetings and Meeting Attendance

The Company’s Corporate Governance Guidelines provide that all directors are expected to regularly attend meetings of the Board and the committees of which they are members and to attend the Annual Meeting of Shareholders.

17

All Board members attended the 20192022 Annual Meeting of Shareholders. The Board met five times during 2019.2022. Each director attended 100% of the meetings of the Board and the Board Committees on which he or she served that were held during 2019,2022, except Mr. BrownMs. Jackson was unable to attend a portionone Audit Committee meeting, and Dr. Wedral was unable to attend one meeting of one Board meeting.

each of the Finance Committee, Compensation and Development Committee, and Board.

Committees of the Board

Executive Committee

The Executive Committee of the Board met twicefour times during 2019.2022. Messrs. Brown, Cichurski,Morrison (joined the Committee following the 2022 Annual Meeting) and Paul Manning (Chairman), Drs. Carleone and Dr. Wedral, and Ms. Whitelaw served on the Executive Committee in 20192022 and are its current members. Mr. Cichurski served on the Executive Committee until his retirement from the Board at the 2022 Annual Meeting. If elected, Ms. McKeithan-Gebhardt will join the Committee following the Annual Meeting. This Committee has the power and authority of the Board in directing the management of the business and affairs of the Company in the intervals between Board meetings, except to the extent limited by law, and reports its actions at regular meetings of the Board.

Audit Committee

The Audit Committee of the Board met nine times during 2019.2022. Messrs. Brown, Cichurski (Chairman),Jain and Morrison (Chairman), Dr. Carleone, and Ms. Jackson served on the Audit Committee in 2022 and are its current members. In addition, Mr. Cichurski served as Chairman of the Audit Committee until his retirement from the Board at the 2022 Annual Meeting, and Ms. Whitelaw served on the Audit Committee in 2019 and are its current members.until February 2023. See “Corporate Governance - Director Independence” below. The Board has determined that Dr. Carleone, and Messrs. Brown, Cichurski,Jain and Morrison, and Ms. Jackson are Audit Committeeeach an “audit committee financial expertsexpert” in accordance with SEC rules. All current members of the Audit Committee meet the independence and experience requirements of the New York Stock Exchange and the SEC applicable to directors generally, and to members of audit committees specifically. None of them serves on the audit committee of any other public company.

This Committee, among other things:

has sole responsibility to appoint, terminate, compensate, and oversee the independent auditors of the Company and to approve any audit and permitted non-audit work by the independent auditors;

reviews the adequacy and appropriateness of the Company’s internal control structure and recommends improvements thereto, including management’s assessment of internal controls and the internal audit function and risk management activities generally;

reviews with the independent auditors their reports on the consolidated financial statements of the Company and the adequacy of the financial reporting process, including the selection of accounting policies;

reviews and discusses with management the Company’s practices regarding earnings press releases and the provision of financial information and earnings guidance to analysts and ratings agencies;

reviews and discusses with the Chief Executive Officer and Chief Financial Officer the procedures undertaken in connection with the Chief Executive Officer and Chief Financial Officer certifications for Forms 10-K and 10-Q and other reports including their evaluation of the Company’s disclosure controls and procedures and internal controls;

obtains and reviews an annual report of the independent auditors covering the independent auditors’ independence, quality control, and any inquiry or investigation of the independent auditors by governmental or professional authorities within the past five years;

sets hiring policies for employees or former employees of the independent auditors;

establishes procedures for the receipt of complaints about accounting, internal accounting controls, auditing, and other compliance matters;

reviews and oversees management’s risk assessment and risk management policies and guidelines generally, including those related to financial reporting and regulatory compliance;

reviews and discusses with management the Company’s material litigation matters; and

18

reviews the adequacy and appropriateness of the various policies of the Company dealing with the principles governing performance of corporate activities. These policies, which are set forth in the Company’s Code of Conduct, include securities law and antitrust compliance, conflicts of interest, anti-bribery, and business ethics.

The Board has adopted a written charter for the Audit Committee, which is included in the Company’s By-laws and posted on its website. The Audit Committee reviews and reassesses the adequacy of this charter at least annually.

Compensation and Development Committee

The Compensation and Development Committee of the Board met fivefour times during 2019.2022. Mr. Morrison and Drs. Carleone (Chairman), Ferruzzi, Landry, and Wedral served on the Compensation and Development Committee in 2022 and are its current members. In addition, Ms. Whitelaw served on the Compensation and Development Committee in 2019 and are itsuntil February 2023. See “Corporate Governance - Director Independence” below. Each current members. Each member of the Committee has been determined by the Board to satisfy the independence requirements of the New York Stock Exchange and the SEC applicable to directors generally and to members of compensation committees.

Among the Committee’s responsibilities are:

to review and approve all compensation plans and programs (philosophy and guidelines) of the Company. In consultation with senior management and taking into consideration recent shareholder advisory votes and any other shareholder communications regarding executive compensation, the Committee oversees the development and implementation of the Company’s compensation program, including salary structure, base salary, short- and long-termlong- term incentive compensation (including the relationships between incentive compensation and risk-taking), and nonqualified benefit plans and programs, including fringe benefit programs;

to review and discuss with management the policies and practices of the Company and its subsidiaries for compensating their employees, including non-executive officers and employees, to ensure those policies do not encourage unnecessary or excessive risk-taking and that any risks are subject to appropriate controls;

to review and make recommendations to the Board with respect to all compensation arrangements and changes in the compensation of the officers appointed by the Board, including, without limitationlimitation: (i) base salary; (ii) short- and long-term incentive compensation plans and equity-based plans (including overseeing the administration of these plans and discharging any responsibilities imposed on the Committee by any of these plans); (iii) employment agreements, severance arrangements, and change of control agreements/provisions, in each case as, when, and if appropriate; and (iv) any special or supplemental benefits; and

at least annually, to review and approve corporate goals and objectives relevant to compensation of the Chief Executive Officer, evaluate the performance of the Chief Executive Officer in light of those goals and objectives, report the results of the evaluation to the Board, oversee and review (at least annually) the Chief Executive Officer succession plan, and set the Chief Executive Officer’s compensation level based on this evaluation.

Sensient designs its overall compensation programs and practices, including incentive compensation for both executives and non-executive employees, in a manner intended to support its strategic priorities and initiatives to enhance long-term sustainable value without encouraging unnecessary or excessive risk-taking. At the same time, the Company recognizes that its goals cannot be fully achieved while avoiding all risk. The Committee and management periodically review Sensient’s compensation programs and practices in the context of its risk profile, together with its other risk mitigation and risk management programs, to ensure that these programs and practices work together for the long-term benefit of the Company and its shareholders. Based on its recently completed review of Sensient’s compensation programs, the Committee and management concluded that Sensient’s incentive compensation policies for both executive and non-executive employees have not had a material adverse effect on Sensient in the recent past and are not likely to have a material adverse effect in the future. See “Compensation Discussion and Analysis” for an analysis of material compensation policies and procedures with respect to the Company’s named executive officers and “Compensation and Development Committee Report” for the Committee’s 2019 report on compensation matters.

Compensation and Development Committee Interlocks and Insider Participation

During the year ended December 31, 2019,2022, none of the members of the Compensation and Development Committee had at any time been an officer or employee of the Company or any of our subsidiaries. In addition, no member of

19

the Compensation and Development Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K adopted by the SEC. During the year ended December 31, 2019,2022, none of the executive officers of the Company served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of the Board of Directors or Compensation and Development Committee of the Company.

Finance Committee

The Finance Committee of the Board met threefour times during 2019.2022. Messrs. Cichurski,Jain and Paul Manning, and MorrisonMs. McKeithan-Gebhardt (Chairman), Ms. McKeithan-Gebhardt, and Dr. Wedral served on the Finance Committee in 20192022 and are its current members.currently serve on the Finance Committee. If elected, Ms. Da Cunha and Ms. Whitelaw will join the Committee following the Annual Meeting. Among other things, this Committee reviews and monitors the Company’s financial planning and structure to ensure conformity with the Company’s requirements for growth and fiscally sound operation, and also reviews and approves:

the Company’s annual capital budget, long-term financing plans, borrowings, notes and credit facilities, investments, and commercial and investment banking relationships;

existing insurance programs, foreign currency management, and the stock repurchase program;

the financial management and administrative operation of the Company’s qualified and nonqualified benefit plans;

the overall hedging strategy and the Company’s use of swaps and other derivative instruments; and

such other matters as may from time to time be delegated to the Committee by the Board or as provided in the By-laws.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board met threefive times during 2019. Mr. Brown,2022. Drs. Ferruzzi and Landry (Chairman), and Mses. McKeithan-GebhardtJackson and WhitelawMcKeithan-Gebhardt served on the Nominating and Corporate Governance Committee in 20192022 and are its current members. If elected, Ms. Da Cunha will join the Committee following the Annual Meeting. Each member of the Committee satisfies the independence requirements of the New York Stock Exchange and the SEC applicable to directors generally.

Among other functions, this Committee:

studies and makes recommendations concerning the composition of the Board and its committee structure, including the Company’s Director Selection Criteria, and reviews the compensation of Board and Committee members;

recommends persons to be nominated by the Board for election as directors of the Company and to serve as proxies at the Annual Meeting of Shareholders;

engages with shareholders regarding potential nominees and other governance issues;

considers any nominees recommended by shareholders;

assists the Board in its determination of the independence of each director;

develops corporate governance guidelines for the Company and reassesses these guidelines annually; and

oversees and evaluates the system of corporate governance and responsibility program,program; and

oversees the Company’s Environmental, Social, and Governance efforts and reviews and approves the Company’s Sustainability Strategy and annual Corporate ResponsibilitySustainability Report.

The Committee identifies, interviews, and recommends candidates it determines are qualified and suitable to serve as a director. Recommendations for Board candidates may be made to the Committee by the Company’s Chief Executive Officer, other current Board members, and Company shareholders. Once appropriate candidates are identified, the Committee evaluates their qualifications to determine which candidate best meets the Company’s Director Selection Criteria, without regard to the source of the recommendation. In accordance with the Director Selection Criteria, the Committee seeks a variety of perspectives, professional experience, education, skills, and other

20

individual qualities and attributes. A copy of the Company’s Director Selection Criteria is attached as Appendix A to this proxy statement. TheMembers of the Committee then interviewsinterview the candidate before making a recommendation to the Board.

Recommendations by shareholders for director nominees may be sent to the Secretary of the Company, who will relay such information to the Committee Chairman. The recommendations should identify the proposed nominee by name; should describe any arrangement or understanding between such person and the nominating shareholder with respect to the nomination, potential service as a director, or the Company’s securities; should describe how the nominee would contribute to the variety of perspectives, professional experience, education, skills, or other individual qualities and attributes sought by Sensient’sthe Company’s Board; and should provide the questionnaire, nominee affirmations, and other materials specified in the By-laws, including the detailed information about the nominee required by SEC rules for the solicitation of proxies for election of directors. Shareholders should look to the information required under the Company’s By-laws for shareholder nominations and to the information included in this proxy statement regarding directors and nominees as a guide.

Shareholders also have the right to directly nominate a person for election as a director so long as the advance notice, nominee affirmations, and informational requirements contained in the By-laws, and applicable law, and SEC rules are satisfied. All nominees must affirm that they have truthfully completed a directors’ and officers’ questionnaire; that they meet the Company’s Director Selection Criteria; that they are not an employee, director, or affiliate of a competitor; that they will protect confidential information and serve the interests of Sensientthe Company and its shareholders collectively; and that they will comply with applicable law and Sensient’sthe Company’s Code of Conduct and other policies and guidelines. In addition to the foregoing requirements, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must also comply with the additional requirements of Rule 14a-19(b) of the Securities Exchange Act of 1934. See “Future Shareholder Proposals and Nominations” below.

Scientific Advisory Committee

The Scientific Advisory Committee of the Board met twice during 2019.2022. This Committee currently consists of Drs. Carleone, Ferruzzi, Landry, and Wedral (Chairman), Messrs. Brown, Cichurski,Jain, Paul Manning, and Morrison, and Mses. Jackson, McKeithan-Gebhardt, and Whitelaw, and additional members that are not directors or officers of the Company. These additional members are Mr. Timothy J. Fink, a retired former Senior Director at PepsiCo, Inc.; Dr. John Floros, Professor in Food Science, Packaging & Process Engineering, New Mexico State University; Dr. Eric Decker, Professor and Head of the Department of Food Science at the University of Massachusetts, Amherst; Dr. Joseph Hotchkiss, Senior Consultant, Packaging Scitech Associates; Dr. Monica Guisti,Giusti, Professor in the Department of Food Science & Technology at theThe Ohio State University; and Carol Kellar, Principal at Kellar & Associates, LLC.

Among other functions, this Committee:

reviews the Company’s research and development programs with respect to the quality and scope of work undertaken;

advises the Company on maintaining product leadership through technological innovation;

reports on new technological trends and regulatory developments that would significantly affect the Company and suggests possible new emphases with respect to its research programs and new business opportunities; and

works directly with management on key innovation and product safety related projects.

Committee Charters, Code of Conduct, and Other Governance Documents

The Charters for the Audit, Compensation and Development, and Nominating and Corporate Governance Committees of the Company’s Board are included in the Company’s By-laws and are available free of charge on the Company’s website (www.sensient.com)(https://www.sensient.com/about-us/corporate-governance). The Company is strongly committed to the highest standards of ethical conduct, and its Code of Conduct for all Company officers, directors, and employees is also posted on the Company’s website. If there are any amendments to the Code of Conduct, or if waivers from it are granted for executive officers or directors, those amendments or waivers also will be posted on the Company’s website.

21

Environmental, Social, and Governance Initiatives

We are committed to the principles of sound environmental stewardship and the responsible and sustainable use of energy and natural resources. All of our facilities are required to operate in compliance with applicable laws and regulations and in a manner to avoid harm to the environment, prevent pollution, and reduce waste. We have a strong record of environmental compliance in our facilities and our products generally have a low environmental impact. However, the environmentally friendly nature of our products and our compliance record will not be enough to meet future sustainability requirements.

Over the past several years, we have refined the way we envision sustainability. In order to increase the transparency of our climate-related disclosures, as of 2020, we prepare our annual Sustainability Report to align with topics and metrics from the Sustainability Accounting Standards Board (SASB) disclosure standards for the Chemicals industry. Additionally, we have aligned our annual Sustainability Report to begin to address the recommendations and supporting disclosures of the Financial Stability Board’s Task Force on Climate-Related Financial Disclosures (TCFD). In 2022, we introduced a clearly-defined sustainability-related performance metric into our annual incentive plan for certain key business leadership. The Compensation and Development Committee approved a waste stream reduction performance metric in order to further incentivize our leadership to optimize resource use and implement circular design principles. In addition, consistent with 2021, we continue to emphasize the reduction of certain inventory (defined by specific quality status codes) in our annual incentive plan for certain key business leadership, which provides additional encouragement to reduce energy and water use, reduce waste generation, and generally promote more efficient, effective, and sustainable business practices within our Groups. For more information, please see “Components of 2022 Executive Compensation and Benefits Programs — Annual Incentive Plan Awards” below.

We have proactively developed an environmental Sustainability Strategy with practical, attainable goals and milestones that will sustain the growth and profitability of our business. The following five pillars are the focus of our sustainability efforts:

Reduce consumption of non-renewable energy and reduce emissions of greenhouse gases.

Improve water efficiencies and decrease water consumption, prioritizing sites in high-stress areas.

Reduce waste and apply the principles of a circular economy.

Build a sustainable supply chain that fully integrates ethical and environmentally responsible practices.

Develop product innovations with lower environmental impacts across the value chain.

Long-term, sustainable value creation and preservation are possible only through a strong governance structure and the Board has delegated to the Nominating and Corporate Governance Committee responsibility for oversight of our sustainability efforts and approval of our annual Sustainability Report.

In addition, we strive to conduct business in an ethical manner and to make a positive contribution to society through our product offerings and business activities. We have a comprehensive Code of Conduct that governs all of our employees worldwide to ensure a culture that promotes ethical behavior, respects and protects human rights, and requires compliance with all applicable laws. Our Code of Conduct also includes a comprehensive set of standards for our suppliers. We rigorously enforce our Code of Conduct.